Exploring Home Equity Loans as a Catalyst for Your Aspirations

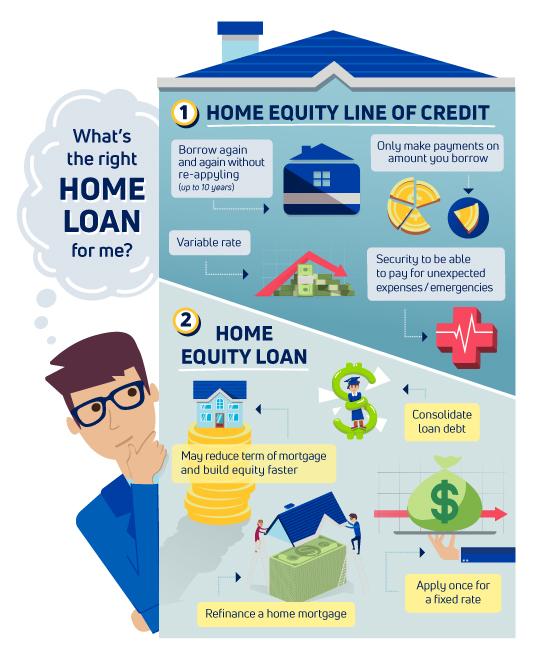

Utilizing a home equity loan can be a transformative decision for homeowners looking to advance their personal and professional goals. By tapping into the value accumulated in their property, individuals gain access to cash that can be put towards various aspirations. Whether it’s funding a child’s education, launching a small business, or making home improvements, the possibilities are vast. Home equity loans often come with lower interest rates compared to other forms of borrowing, making them an attractive option for those in pursuit of their dreams.

When considering a home equity loan, it’s crucial to evaluate how it aligns with your financial strategy. Here are some key factors to keep in mind:

- Interest Rates: Typically more favorable than credit cards or personal loans.

- Tax Deductions: The interest paid may be tax-deductible under certain conditions.

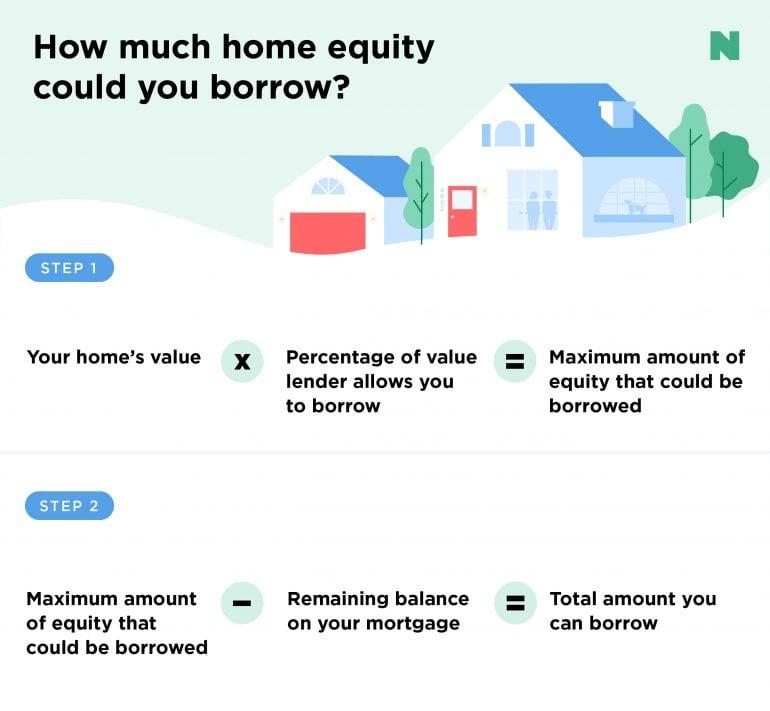

- Loan Amount Flexibility: Borrow based on the equity built in your home.

- Potential Risks: Ensure you understand the implications of using your home as collateral.

By conducting thorough research and consulting with financial advisors, homeowners can effectively harness the power of home equity loans to fuel their aspirations, ultimately allowing them to dream big while securing a stable financial future.

Understanding the Advantages of Leveraging Your Homes Value

Home equity loans provide homeowners with a remarkable opportunity to tap into their property’s worth, enabling them to unlock substantial financial resources without the need to sell their homes. This financial strategy hinges on the principle that as mortgage payments are made and property values potentially increase, homeowners can access additional funds that may be used for a variety of purposes. By leveraging their home’s equity, individuals can pursue significant life goals, such as funding education, embarking on renovations, or consolidating high-interest debts, all while potentially enjoying lower interest rates compared to traditional loans.

Moreover, utilizing a home equity loan can lead to long-term financial benefits. With the potential for tax-deductible interest payments, homeowners can effectively manage their investments while enhancing their property’s value. Key factors that make this option particularly appealing include:

- Increased Purchasing Power: Home equity loans can provide large sums of money for essential projects or investments.

- Flexible Usage: Funds can be directed towards anything from emergency expenses to dream vacations.

- Potential for Increased Home Value: Strategic renovations funded by these loans can lead to a higher resale price down the line.

Strategic Tips for Maximizing Your Home Equity Loan Potential

To truly harness the potential of your home equity loan, begin by conducting a comprehensive assessment of your financial situation. Evaluate your current debt obligations, income stability, and upcoming expenses. This introspection is crucial in determining how much equity you can safely leverage. Once you have a clear financial picture, consider the following strategies:

- Prioritize High-Return Investments: Invest in renovations or upgrades that increase your home’s value, such as kitchen remodels or energy-efficient appliances.

- Consolidate High-Interest Debt: Use the loan funds to pay off credit card debts or personal loans, potentially lowering your monthly payments.

- Plan for Future Expenses: Set aside a portion for essential future expenses, such as education or medical bills, ensuring you’re prepared for unexpected costs.

Additionally, keep in mind the importance of maintaining a disciplined repayment strategy. A well-structured repayment plan will not only help you manage your cash flow but also protect your credit score. Effective practices include:

- Automating Payments: Set up automatic monthly deductions to never miss a payment.

- Creating a Budget: Factor your loan repayment into your monthly budget to keep financial goals on track.

- Regularly Reviewing Your Finances: Schedule periodic assessments to ensure you’re on track with payments and explore opportunities for refinancing if interest rates drop.

Key Considerations to Ensure a Successful Borrowing Experience

When considering a home equity loan, several crucial factors can significantly impact the success of your borrowing experience. Understanding your financial health is paramount; assess your credit score, existing debts, and income stability to ensure that you qualify for favorable loan terms. It’s also essential to determine the amount of equity you can access, as this will dictate your borrowing limits. Highlighting your purpose for the loan—be it for home renovations, debt consolidation, or education—will not only guide your decision-making but also demonstrate to lenders your ability to repay. Furthermore, comparing lenders can yield better interest rates and terms that suit your unique financial situation.

Another key consideration is the loan’s overall costs. Interest rates, closing costs, and potential fees associated with the loan can vary widely among lenders, necessitating thorough research and comparison. Be mindful of the repayment terms; longer terms may offer smaller monthly payments but can lead to higher overall costs due to interest accumulation. Lastly, make sure you have a solid repayment plan in place. Guiding yourself through this process with a clear financial strategy will empower you to make informed decisions, ensuring you fully leverage the benefits of your home equity loan while minimizing the risks involved.

a home equity loan can be a powerful tool for homeowners looking to turn their grandest aspirations into reality. Whether it’s funding a dream renovation, consolidating debt, or investing in education, the equity in your home could be the key to unlocking new opportunities. However, as with any financial decision, it is crucial to approach this option with careful consideration and a clear understanding of the terms involved. By weighing the potential benefits against the risks and consulting with financial experts, you can make informed choices that align with your long-term goals. So, as you contemplate your dreams, remember that the path to achieving them might just be a loan away—if you’re ready to harness the power of your home’s equity responsibly.